Buy Now, Pay Later

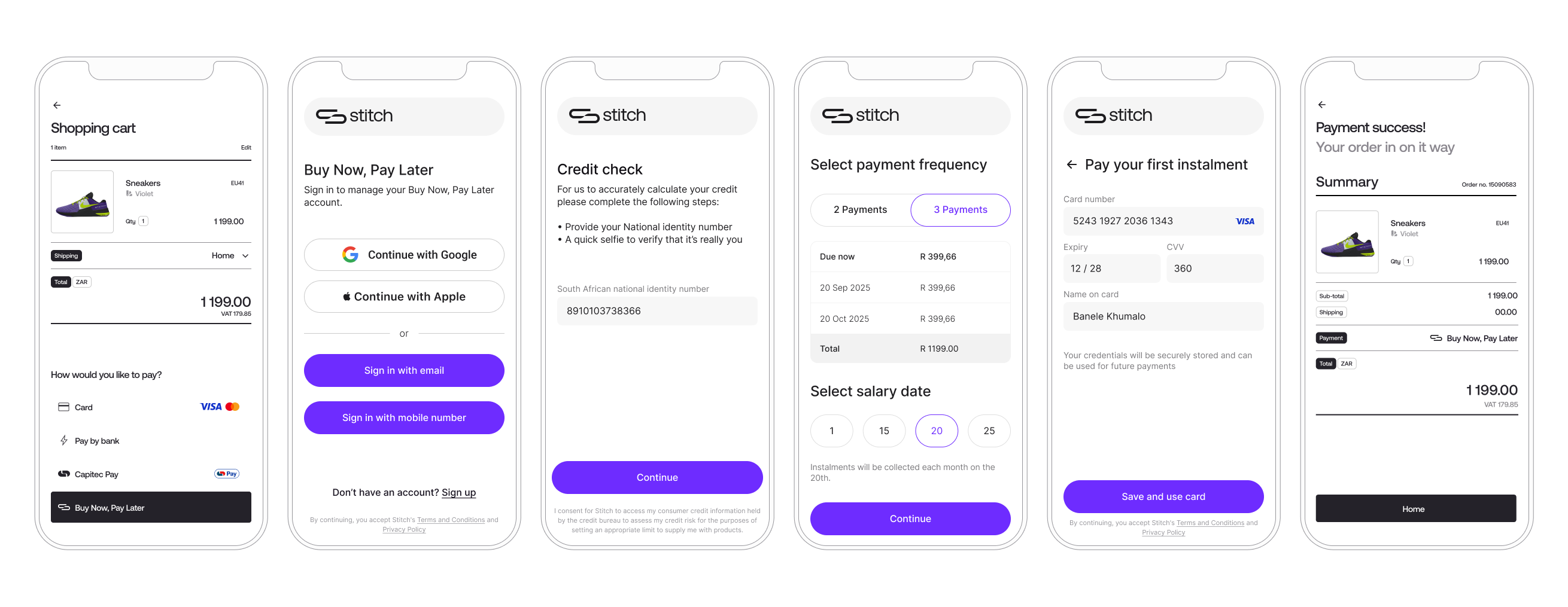

Stitch’s Buy Now, Pay Later (BNPL) solution empowers consumers with greater purchasing flexibility, enabling them to manage expenses more comfortably while retaining their existing reward benefits. By seamlessly integrating into your platform’s checkout experience, BNPL simplifies the payment process and enhances customer satisfaction.

With Stitch BNPL, consumers can use their existing Visa or Mastercard to pay for purchases in monthly instalments over a period of 2 to 6 months — all without interest or additional credit applications. Stitch handles the payment setup and collection directly with users, allowing them to complete purchases instantly and receive goods or services upfront. The result is a frictionless checkout that drives higher conversion rates and increases sales for merchants.

Get started with the seamless API integration process for BNPL here.

Settlement Options

Stitch BNPL offers two settlement options, providing flexibility to merchants based on their cash flow needs and financial preferences:

- Upfront Settlement: Merchants receive the full purchase amount immediately after a completed payment request. This option supports immediate cash flow, helping with inventory replenishment, covering operational expenses, and reducing collection risk.

- Instalment Settlement: Merchants are settled in increments as instalment payments are collected from end-users. This option aligns settlement with the BNPL repayment schedule, offering lower fees from Stitch and distributing revenue over the instalment period.